Santa Savings: Make a Holiday Budget For a Debt-Free Christmas

Wading into the holiday season without a financial plan can have a serious impact on the bottom line. Fight back with a power tool: a Christmas holiday budget. Free printable!

For many families, Christmas comes not once a year, but lingers on for months! Credit card bills arrive shortly after season’s end, not to be paid off until the following summer. Nearly two-thirds of American families don't know the true cost of their own Christmas celebration--and if they did, they'd be shocked. That much ... for a single day?

Fight the seasonal spending spree with the financial tool of choice: a Christmas budget. Try these ideas to create--and keep!--a holiday budget to save money on Christmas.

A budget is more than just a piece of paper! It’s a dynamic way to allocate funds and track spending. Used properly, a budget provides an at-a-glance picture of where your spending falls against your goals.

Knowing where the fiscal limits lie will help you avoid the financial fuzziness that permits Christmas to burden the remainder of the year. Take a deep breath ... and get ready for a debt-free Christmas!

First things first

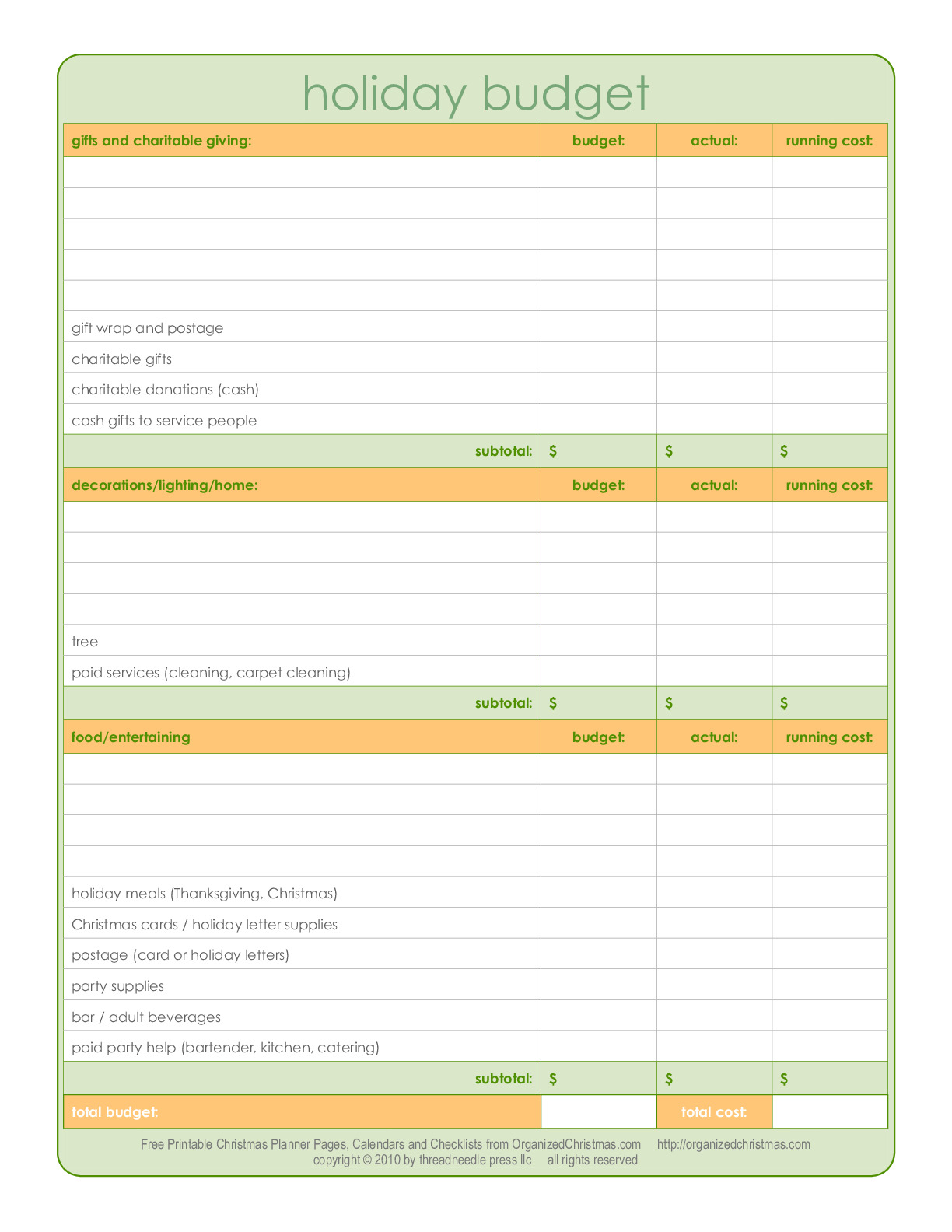

To get grounded before you begin making gift lists and dreaming of décor ideas, set the season’s financial limits with a Christmas budget. Use our printable Christmas holiday budget, or make your own using a blank page in the Christmas planner.

To create a Christmas budget, you’ll need to (1) list spending categories, (2) set spending goals, and (3) track ongoing expenditures.

List categories

To begin, list all categories for your family’s holiday spending. Budget categories might include:

- Gifts

- Stocking stuffers

- Gift wrap

- Postage and shipping

- Christmas cards

- Holiday photo

- Tips and service gifts

- Holiday meals

- Baking and kitchen gifts

- Entertaining

- Décor items and Christmas tree

- Home improvements

- Travel expenses

- Holiday clothing

- Charitable donations

- Post-Christmas sales

Set spending goals

Next to each category, decide on a spending limit. Allocate available funds according to the most important categories; a year with heavier-than-usual spending on holiday meals may mean making do with no new decorations or trimming back spending on holiday cards.

When setting spending goals, keep the bottom line in mind! Sure, you’d love to bring in a carpet-cleaning service for the whole house before the holiday, but if the estimate exceeds your entire décor budget, it’s time for good workout with a rented carpet steamer.

When you’ve assigned a spending goal to each category, take a deep breath and add it up. Congratulations! You’re one of the minority who knows the true cost of the Christmas season.

If that cost seems out of balance, adjust spending goals downward. Look for low-cost/no-cost ways to celebrate the season without breaking the bank!

Track ongoing expenditures

Check the budget before you spend as an instant reality check on seasonal excess. After you spend, record actual spending to stay aware of the cost of the season. At least weekly, update current spending totals, and compare them to spending goals.

At season’s end, add this year’s budget to the Christmas Past divider in your Christmas planner. Reviewing last year’s expenditures (over-spending and all) is a great reality check as you begin to plan for a new season.